The scoring is a binary scoring from 9 items taken from a companies financial statement.

its not easy to come up with these items as many companies dont publish or if they do you have to pay to see or do alot of googling to research.

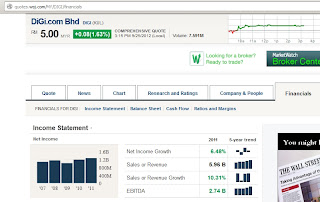

Im using this website: http://quotes.wsj.com

simply search for a quote to open up the page. im searching for DIGI malaysia with the following result page: http://quotes.wsj.com/MY/XKLS/DIGI?mod=DNH_S_cq

Im looking at the financial tab:

these are the items you need to find before scoring:

A. Net profit or Net Income

B. Operating cash flow

C. Total Asset or Asset turnover

D. Total Current Asset

E. Long Term Debt

F. Gross margin

G. Current Liability

So you have all the data you need and ive shown you where to find them. Now for the 9 Items.

NOTE (REMEMBER) F-SCORE is a BINARY Scoring system

1. ROA: Net income before extraordinary items, one point awarded if positive, zero otherwise.

Item A

2. CFO: Cash Flow from Operations, one point awarded if positive, zero otherwise.

Item B

3. ΔROA: This is the net profit divided by the assets. Current year's Return on Asset less the prior year's ROA. One point awarded if positive, zero otherwise.

Item A / Item C

4. ACCRUAL: Current year's net income before extraordinary items less cash flow from operations. The indicator variable F-ACCRUAL equals one if CFO > ROA

Item B > Item A

5. ΔLEVER Decrease in liquidity. If the long term debt divided by the average assets is lower this year than the prior year, then score 1

Item E / Average Item C

6. ΔLIQUID: This variable measures the historical change in the firm's current ratio between the current and prior year. current assets divided by the current liabilities. If this year’s figure is greater than last year, score 1

Item D / Item G

7. EQ-OFFER: This indicator will equal one if the firm did not issue common equity in the year preceding current year, zero otherwise.

i think this is what it means!?!?!

8. ΔMARGIN: The firm's current gross margin ratio. An improvement in margins signifies a potential improvement in factor costs, a reduction of inventory costs, or a rise in the price of the firm's product. F-ΔMargin will equal one if ΔMARGIN is positive, zero otherwise.

Item F

9. Asset Turnover. If asset turnover this year is greater than asset turnover last year, then score 1.

| YTL | DIGI | |

| Item 1 | 1 | 1 |

| Item 2 | 1 | 1 |

| Item 3 | 1 | 1 |

| Item 4 | 0 | 0 |

| Item 5 | 1 | 1 |

| Item 6 | 1 | 1 |

| Item 7 | 1 | 1 |

| Item 8 | 0 | 0 |

| Item 9 | 1 | 1 |

| 7 | 7 |

Final Score is just adding

After summing the results for all 9 tests, stocks with higher scores are better investments. Piotroski’s stock-picking strategy involves picking the cheapest stocks in the market, and buying those with an F-Score of 8 or 9.

No comments:

Post a Comment